Mortgage how much can i borrow based on salary

Theres not enough information in the question to provide a definitive answer but I would like to correct some of the misinformation here. This article explains how mortgage lenders determine the maximum amount you can borrow based on your income.

Mortgage Affordability Calculator 2022

Cash Out Refinance available with all Angel Oak products.

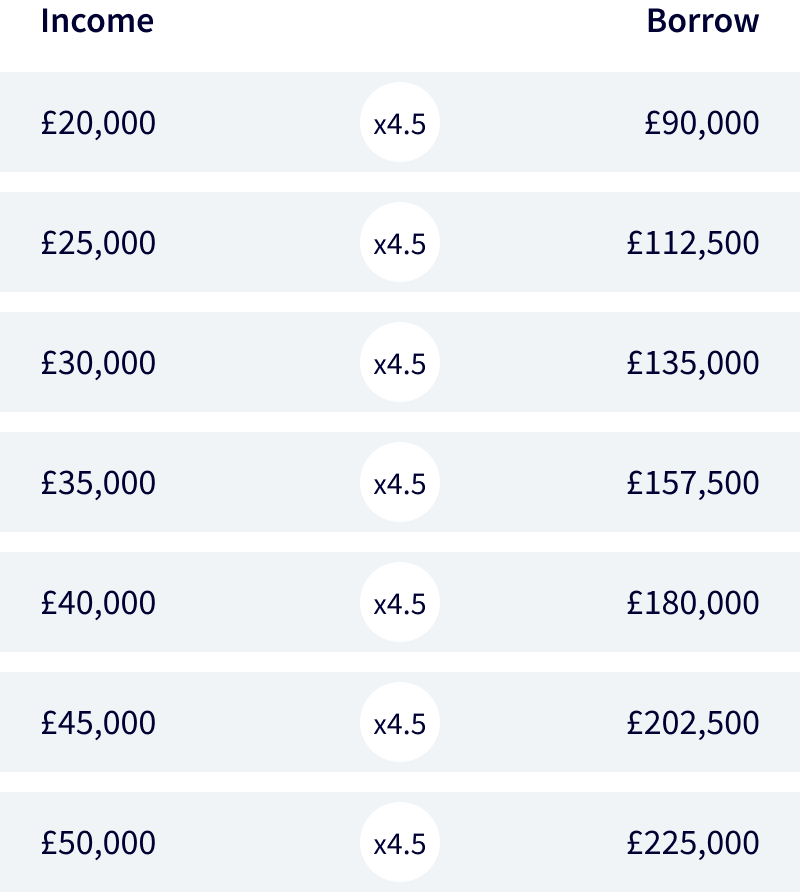

. Ad Compare Mortgage Options Get Quotes. How To Get a Mortgage. Generally lend between 3 to 45 times an individuals annual income.

Cash Out Refinance available with all Angel Oak products. Loans up to 3 million. Fill in the entry fields and click on the View Report button to see a complete amortization schedule of.

When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the. Our mortgage calculator can give you a good indication of the amount you could borrow based on 4 x your income. How much you can borrow is based on your debt-to-income ratio.

Take the First Step Towards Your Dream Home See If You Qualify. Loans up to 3 million. Lock Your Mortgage Rate Today.

The first step in buying a house is determining your budget. Mortgage lenders in the UK. Find Out Which Mortgage Loan Lender Suits You The Best.

Save Time Money. Take Advantage Of 2022 Mortgage Rates When You Buy Your Next Home. How much can I borrow.

We calculate this based on a simple income multiple but in reality its much more complex. About this mortgage calculation. While its true that most mortgage lenders cap the amount you can borrow based on 45 times your income there are a smaller number of mortgage providers out there who are willing to.

Ad NerdWallet Reviewed Mortgage Lenders To Help You Find The Right One For You. Ad Optimize home value by tapping into equity in your home. Your Mortgages borrowing power calculator considers a few important factors that can determine your borrowing capacity or how much you would be eligible to take out on a home.

This mortgage calculation analyses the amount you and your partner earn each year and provides a benchmark amount that you could expect to borrow from a mortgage lender. Were Americas 1 Online Lender. But ultimately its down to the individual lender to decide.

For instance if your annual income is 50000 that means a lender. Ad Knowing How Much You Can Afford Is The First Step Towards Homeownership. Answer 1 of 4.

This article explains how mortgage lenders determine the maximum amount you can borrow based on your income. Ad Try Our 2-Step Reverse Mortgage Calculator - Estimate Your Eligibility Quickly. If a mortgage is for 250000 then the mortgage principal is 250000.

Determine Your Monthly Mortgage Budget By Using Our Home Affordability Calculator Today. Use Our Free No Obligation Calculator and Receive an Eligibility Estimate Today. Lenders do not look at the borrowers.

Ad First Time Home Buyers. When you apply for a mortgage lenders calculate how much theyll lend. To calculate how much you can borrow for a mortgage.

As you can see a couple earning 50k. Calculate what you can afford and more. How Much Mortgage Can I Afford Generally speaking most prospective homeowners can afford to finance a property whose mortgage isbetween two and two-and-a.

The higher mortgage rate has reduced their home buying. As part of an. Its A Match Made In Heaven.

Check Your Eligibility for a Low Down Payment FHA Loan. This is the percentage of your monthly income that goes towards your debts. Your annual income before tax Salary 000.

Mortgage principal is the amount of money you borrow from a lender. How much can you borrow. Current Mortgage Rates Up-to-date mortgage rate data based on.

The Canstar research team crunched the numbers to show you how much you can afford to borrow on various salaries if you want to avoid mortgage stress. You pay the principal with interest back to. Looking For A Mortgage.

Ad Optimize home value by tapping into equity in your home. Suddenly the maximum amount they can borrow on their salary drops to 471000 or 47 times their salary. Primary and Investment Property.

Ad Get Instantly Matched With Your Ideal Mortgage Loan Lender. Depending on a few personal circumstances you could get a mortgage. Get Started Now With Quicken Loans.

If your down payment is 25001 or more you can find your. Fill in the entry fields. This mortgage calculator will show how much you can afford.

Primary and Investment Property. Generally lend between 3 to 45 times an individuals annual income. This calculator is designed to illustrate how much you could borrow when approaching a mortgage lender to take out a mortgage based on your income.

How Many Times My Salary Can I Borrow For A Mortgage Canadian Real Estate Wealth

Explained Why One Should Get Instant Loans In India Instant Loans Instant Loans Online Instant Money

Top 5 Reasons People Take Out Personal Loans Personal Loans Unsecured Loans Person

Mortgage Affordability Calculator Based On New Cmhc 2022 Rules Wowa Ca

The Evolution Of Financing Small Business Finance Business Finance Finance

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

Yen Mortgage Loan Calculator How Much Can You Afford To Buy In Japan Blog

A Home Of Your Own Living Room Theaters Home Buying Living Room Bench

How Many Times My Salary Can I Borrow For A Mortgage Canadian Real Estate Wealth

Rupeeredee Is A Digital Platform That Helps Customers Borrow Money For Their Short Term Needs At The Click Of A Butto Personal Loans Borrow Money The Borrowers

Mortgage Affordability Calculator Based On New Cmhc 2022 Rules Wowa Ca

Resources For Calculating Student Loan Repayment Student Loan Repayment College Costs Financial Aid

Can You Get A Mortgage With A Part Time Job Uk Nuts About Money

Can You Get A Mortgage With A Part Time Job Uk Nuts About Money

Mortgage Down Payment Calculator 2022 Mortgage Rules Wowa Ca

Still Waiting For The Salary Just Get Yourself Rupeeredee Instant Personal Loan Pay Your Bills On Time Isn T It Simple C Personal Loans Borrow Money Loan

How Student Debt Makes Buying A Home Harder And What You Can Do About It Student Loan Payment Mortgage Approval Student Loan Debt